It’s an exciting time to invest in cannabis as a generational wealth creation opportunity. The legal cannabis industry is projected to grow to $100 billion in 2030, and the investment opportunities are enormous.

Key Reasons to Invest in Cannabis Now

Cannabis is a market where consumer demand already exists, but there is a lack of professional venture capital to support business growth. As a result, cannabis businesses are actively looking for investors, which equates to significant opportunities for smart angel investors.

Consumer Demand Already Exists

Because demand exists, investors are essentially investing in the transition of a $75 billion (U.S.) annual illicit (“informal”) market to a legal (“formal”) market. In the United States, legal cannabis sales are forecasted to reach $23.6 billion in 2021, less than a third of the estimated amount sold annually in the informal market. Growth is assured as users look to change their purchasing habits and embrace the quality control of the formal market.

Lack of Professional, Institutional Venture Capital Funds

A lack of institutional investors, loan capital, and professional venture capital in the cannabis industry creates a supply and demand imbalance which results in a buyer’s market.

Today, there are approximately 35 early and growth-stage funds with an aggregate approximate $700M AU.M. Additionally, there is some family-office capital pursuing this sector. While angel investors, private equity, and venture capital are increasing, they’re still a small share of what is required to finance the industry.

Where to Focus as an Angel Investor Right Now

Savvy cannabis investors are looking at many opportunities. Here are five areas of focus:

1. Cannabis Consumer of the Future

The future of the cannabis industry isn’t limited to consumers who already consume. Additional growth will come from consumers who are not consuming yet.

Think of the health-conscious soccer mom who trades her evening glass of wine for a low microdose cannabis-infused drink that has fewer calories and no sugar. Smart investors are looking at companies serving these new consumers with innovative product experiences and new form factors.

2. Single or Dual-state Operators

Investors are focused on high-performing operators with footprints in one or two states that will likely get acquired by larger multi-state operators.

Top publicly held multi-state operators (MSOs) have been acquiring cannabis businesses across the country while dramatically increasing revenue and becoming profitable. Second-tier MSOs are aggressively expanding their footprints, and mergers and acquisitions are happening with increased frequency. All of this adds up to more opportunities for cannabis investors.

3. Defensible Positions in the Supply Chain

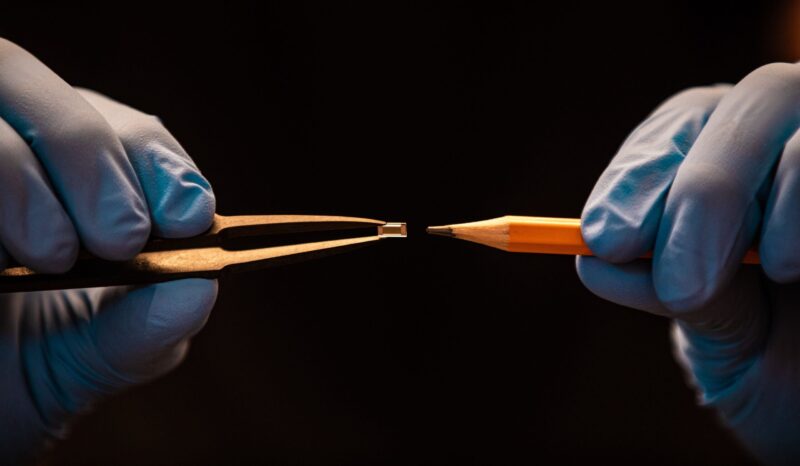

Investment opportunities can be found across the cannabis supply chain, and investors are looking at companies with competitive advantages that are not easily duplicated.

These companies have developed a unique process, product, or service that gives them a position which is easy to defend. Such a company likely has valuable intellectual property — patents, trade secrets, trademarks, or copyrights — that ensure it has an exclusive right to protect its competitive advantage for a significant period of time.

4. Re-definition of Medical Cannabis

The medical cannabis market is being threatened by the adult-use market and the pharmaceutical industry, which wants the U.S. Food & Drug Administration to consider cannabis a drug.

However, smart investors predict that medical cannabis will be redefined and create a growing over-the-counter (OTC) business.

As a result, investors are looking at how the repositioning of the medical market could create growth and investment opportunities.

5. Northeast

In the near future, New Jersey, New York, Connecticut, Rhode Island, Pennsylvania, and Virginia will all have operational adult-use markets open and thriving. High population density ensures the Northeast will represent the next dominant cannabis market.

Companies in these states are scrambling to raise money and new brands will debut soon, which will bring huge opportunities for investors.

Cannabis Investing Opportunities Abound

As we enter 2022, all signs point to now being the time to continue, or begin investing in cannabis companies. Yes, there are challenges in investing in this sector, but the growth should outweigh those risks.

Still unsure if now is the time to invest? Think of it this way. Market growth is coming in the short-term as more states roll out new medical and adult-use programs, and significant projected growth is coming in the long-term through federal legalization, social normalization, and expanded state programs.

The picture is clear. Now is the time to invest in cannabis.

Author

-

Named one of the “25 Angel Investors in New York You Need to Know” by AlleyWatch, Jeff Finkle has been a venture investor for ten years and an angel investor for eight years. Jeff is presently CEO of the Arcview Group and Arcview Ventures and co-founder of the Arcview Collective Fund, the first member-managed fund in cannabis. He also serves as Chairman of the Evaluation Committee and Treasurer of the Angel Round Capital.