The U.S. Department of Justice (DOJ) recently announced its intention to reschedule cannabis from Schedule I to Schedule III under the Controlled Substances Act, rekindling interest in the cannabis industry from financial services and investor communities.

While this shift in policy holds promise, it’s crucial to understand its potential impact on banking, payments, insurance, and lending in the financial services sector, including banking, payments, insurance, and lending.

Rescheduling cannabis to Schedule III would ease some restrictions compared to its current Schedule I classification. Schedule III substances are acknowledged for their medicinal benefits and are considered to have a lower abuse potential than Schedule I substances.

This move could stimulate research, enabling scientists to explore the therapeutic uses and safety aspects of cannabis. There is special interest among veterans groups as an option to avoid highly addictive drugs currently used for pain, PTSD, depression, and anxiety.

The adjustment might also encourage FS companies to engage more confidently with the cannabis industry, potentially normalizing the sector and aligning FS offerings to cannabis businesses, more closely with the full menu of FS products available to other high-risk markets like alcohol and gambling.

However, it’s important to recognize what the rescheduling does not accomplish:

- Legalization: Rescheduling to Schedule III does not equate to full federal legalization, posing challenges for FS companies serving the market.

- Immediate FS Accessibility: While rescheduling may prompt FS companies to reconsider their stance on cannabis, federal legality issues still make it difficult for regional and national FS companies to operate in this sector, especially across state lines (e.g., payment networks like Visa and Mastercard, national and regional banks or insurers, or any financial company doing business across state lines).

- Overriding State Laws: Cannabis regulations vary by state, creating compliance burdens for FS companies. Once a FS company’s business crosses state lines, it triggers interstate and federal laws, regardless of the status of cannabis within a state. Thus, most FS companies will wait for further clarification and legal adjustments before fully committing to the cannabis market. Uniform laws would reduce these hurdles, but in the meantime, compliance remains complex and costly.

The good news in this is that there are well proven companies that can help FS institutions to comply without having to hire an army of expert staff. Check out EMCoalition and ACBA for the handful of organizations vetted and actively serving the FS companies in compliance and operations, for the cannabis market.

The DOJ, in conjunction with the Department of Health and Human Services (HHS), has initiated a public comment period, and the timeline for the full process remains uncertain. The impact on stocks, investors, and lenders is also uncertain, influenced by factors beyond rescheduling.

Cannabis business owners can take steps to prepare for the changing landscape, particularly in FS offerings:

- Stay Updated and Engaged: Monitor the rescheduling progress and participate in the public comment period. Post your own comment to the DOJ and HHS comment platforms; all comments are read, and your letter may be considered in the rule-making process.

- Seek Professional Guidance: Consult experts in banking, compliance, law, and accounting specializing in cannabis.

- Prepare for Scrutiny: Anticipate increased regulatory oversight as rescheduling progresses—both federal and state.

- Build Relationships with FS Providers: Foster connections with FS companies specializing in cannabis. Leverage the proven companies to support you (see EMCoalition.org and TheACBA.org as non-profit sources of education and providers).

- Highlight Benefits: Use the rescheduling as an opportunity to promote product quality and effectiveness in your education, messaging, and marketing.

- Support Research: Encourage cannabis-related research, especially on the medical front, to enhance industry acceptance.

The cannabis industry stands at a pivotal moment. While rescheduling to Schedule III may not solve all issues, it signifies a significant policy shift that could normalize FS offerings and lower pricing for banking, payments, insurance, and lending. Business owners and investors who stay informed and adaptable will be better positioned to succeed in this evolving industry.

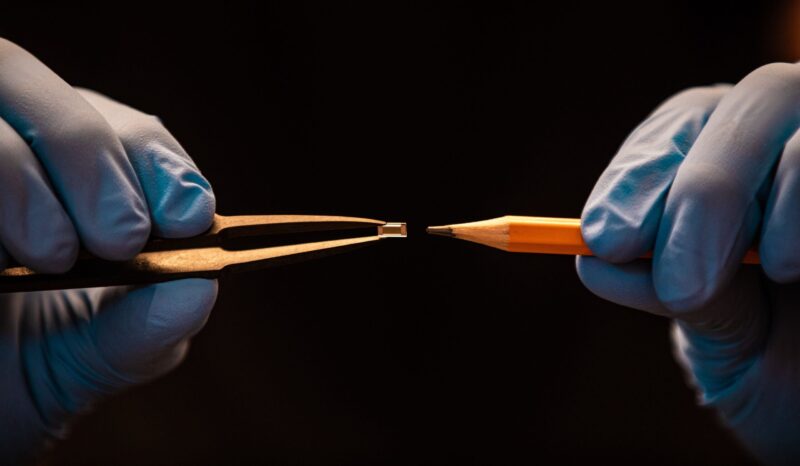

Main Photo by Alexander Mils on Unsplash

Author

-

Kirsten Trusko is the CEO and Co-Founder of Emerging Markets Coalition – a 501c3 coalition of top financial services (FS) organizations – banking, payments, lending, insurance, investing. EMC is focused on normalizing FS for cannabis – to expand the span of products offered, with pricing on par with similar businesses.