Many would argue 2020 has been the most stressful year in a generation.

Between a polarizing U.S. presidential election, a novel coronavirus pandemic claiming more than 268,000 lives from 13.6 million reported cases (as of November 30),, the fluctuating, unreliable data, and millions of people who may be stressing out due to ongoing isolation from their loved ones due to rolling lockdowns and social distancing measures, as well as rising unemployment with no end in sight, it is understandable for Americans to have a sense of heightened anxiety and insecurity.

Between a polarizing U.S. presidential election, a novel coronavirus pandemic claiming more than 268,000 lives from 13.6 million reported cases (as of November 30),, the fluctuating, unreliable data, and millions of people who may be stressing out due to ongoing isolation from their loved ones due to rolling lockdowns and social distancing measures, as well as rising unemployment with no end in sight, it is understandable for Americans to have a sense of heightened anxiety and insecurity.

However, one set of data that can be relied upon is that Americans are turning en masse to cannabis, and cannabis delivery, to ease their tensions during these trying times.

Enter the rise of cannabis delivery companies and the ancillary services that power them.

Lantern: A Light in the Darkness

Lantern is an independently-operated cannabis e-commerce marketplace and delivery platform in the U.S.

It is a sister brand powered by the same technology as the alcohol e-commerce platform, Drizly.

With the speed and convenience of on-demand delivery, Lantern partners with local dispensaries and cannabis brands to bring transparency, safety, and access to cannabis for both new and experienced consumers through intuitive, personalized shopping experiences.

Lantern’s expertise in regulated industries helps dispensaries operationalize on-demand delivery.

This process allows its customers to reach new customers, tap into key consumer insights, and diversify their businesses to grow sales.

According to its website, Lantern’s on-demand cannabis home-delivery platform provides

legal, convenient access to cannabis dispensaries and their products for state-issued medical marijuana cardholders.

The interface compares various dispensaries’ product selections and pricing, enabling patients to place dispensary orders with direct fulfillment to the customer’s home.

From customers who are overwhelmed with choices but want to explore cannabis with confidence, Lantern aspires to bring transparency, equity, and access to cannabis.

Jane Says She’s Done with Sergio

Jane is a similar online cannabis marketplace with a network of over 1,300 dispensaries in 28 states that provides online pre-ordering and delivery.

After receiving a call from one of their San Francisco dispensary partners on Friday, March 13, Jane debuted a software update that allows for curbside orders and pickup within 24 hours.

This capability is effectively keeping dispensaries like Harborside, The Apothecarium, and Airfield in business and preventing patients’ medicine and related supplies from running low.

Jane Technologies, Inc. is the retail technology company that created the cannabis industry marketplace iheartjane.com, which provides consumers with a reliable and intuitive shopping experience.

Users can browse local products in real-time, compare by price, proximity, popularity, and then place orders at local dispensaries for free.

As people continue to shop online at increasing rates, Jane also works hand-in-hand with brands to create innovative ways to stand out to the consumer in lieu of in-person budtender recommendations, including brand modules and verified customer reviews.

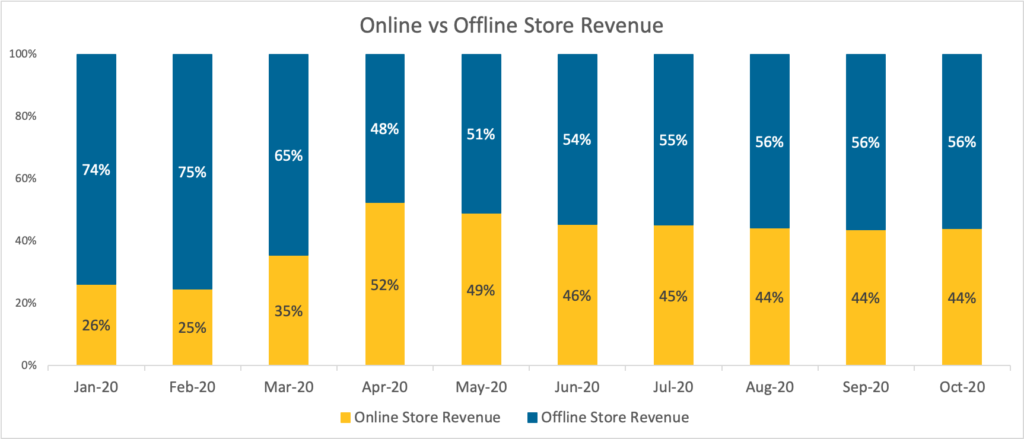

Data from over 1600 dispensaries shows the initial, significant increase to online cannabis purchasing, falling, and then leveling at a much higher rate than pre-COVID-19 times.

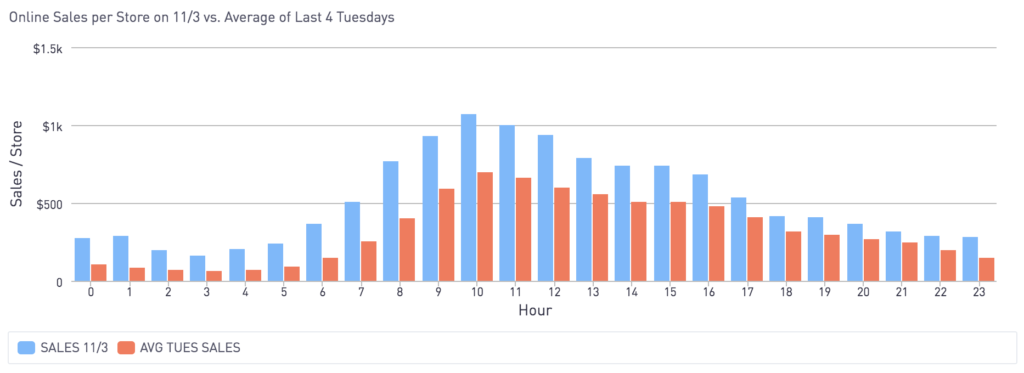

On a related note, Jane calculated an enormous uptick in orders on election night.

The company recorded 60% higher online sales per store throughout the day, with hourly increases.

“The future of retail has always been digital, and the pandemic only served to accelerate that. At this moment in time, we have the chance to merge technology and retail infrastructure in an entirely new way, where digitization can support brick-and-mortar businesses rather than replace them,” said Socrates Rosenfeld, CEO, and co-founder of Jane Technologies.

“At Jane, we’re grateful to have the opportunity to help shape the future of retail for the new digital age, where customers can shop online from local retailers with the same level of safety, convenience, and curation as when shopping on Amazon.”

Drop it Like it’s Hot

As far as how Drop Delivery stacks up to Lantern or Jane, the latter two platforms are marketplaces for cannabis consumers to discover local retailers and shop from them.

According to Vanessa Gabriel, CEO and co-founder of Drop Delivery, her company is different because it provides a turnkey solution.

“As an all-in-one delivery management for retailers, Drop provides our clients with the necessary software needed to run their day-to-day operations and scale their businesses.”

Drop is a proprietary Software as a Service (SaaS) company or a software distribution model.

A third-party provider hosts applications and makes them available to customers over the internet.

Drop aims to provide a delivery service with everything the company could need to streamline and elevate its user experience.

Drop’s software provides companies with a branded e-commerce app, customizable rewards, loyalty program, SMS texting to communicate with customers, and deals designed to increase revenue.

Additionally, Drop offers necessary compliance integration with the cannabis regulatory system METRC for evolving individual state regulations.

Similar to other big-box delivery companies, Drop provides last-mile delivery logistics to track drivers and deliveries and a dashboard to manage everything from inventory to staff.

Gabriel agrees that delivery sales are up, industry-wide, across all demographics and specific consumer packaged goods (CPG) categories, such as edibles.

She attributes these increases to the need for coping mechanisms during the pandemic.

She attributes these increases to the need for coping mechanisms during the pandemic.

“A client of ours is experiencing their average sales up 150%, compared to pre-pandemic sales,” says Gabriel. “Our clients show increases in their customers purchasing edibles. This uptick can be due to customers ordering items to assist with anxiety and stress from the state of the world at the moment. However, what we see that is promising is the repurchase-rate is up dramatically by 59%.”

Additional sales may be attributable to the increase of at-home or off-site office environments.

The average order value (AOV) tracks the median dollar amount spent every time a customer places an order on a mobile app or website.

To calculate a company’s average order value, it divides the total revenue by the number of orders.

According to Gabriel, Drop’s AOV rate is up by 36% compared to before the pandemic.

“Customers are ordering more frequently and purchasing more items per transaction,” she says.

As JFK once said, “A rising tide lifts all boats.” On that note, substantial evidence supports the growth potential of all three ancillary cannabis companies.

Author

-

Sara Brittany Somerset is a United Nations & cannabis correspondent based out of UN HQ in New York, NY and Orange Hill, Jamaica.