Cannabis and wellness products are everywhere, but consistency and effectiveness are often a guessing game. Leading the team is Rick Cytrynbaum, a veteran of the fashion world turned cannabis innovator. According to Cytrynbaum, Capsoil is tearing up the rulebook on how cannabinoids, nutraceuticals, and other bioactive compounds reach the bloodstream. This offers a faster, cleaner, and more reliable result than anything old-school methods ever delivered.

After meeting Capsoil’s founder and CTO, Raphael Ezra, Cytrynbaum realized the company had the potential to transform how cannabinoids, hemp derivatives, nutraceuticals, and even topicals are absorbed in the human body.

The challenge begins with biology. Cannabinoids like THC and CBD are lipophilic, shunning water and clinging to fats, which complicates their journey through the aqueous gut. Upon ingestion, they face the liver’s first-pass metabolism, where enzymes dismantle much of the dose before it circulates. Studies peg oral bioavailability at a meager 14-22% for THC, sometimes climbing above 20% in optimized extracts. Users report frustration as effects arrive unevenly, influenced by meals, metabolism, or hydration. In medical contexts, this variability undermines trust—particularly for chronic pain or nausea sufferers who cannot afford trial and error.

Industry observers note the toll on adoption. Edibles, despite their discretion and longevity, trail inhalation methods in sales partly due to this unpredictability. A 2025 report from BDSA reveals that while the U.S. edibles sector hit $2.57 billion last year, fast-onset variants captured just 3% of the gummy subcategory yet commanded 31% higher retail prices. Consumers, it seems, reward speed and reliability.

“People want experiences they can trust and predict, and fast onset is a key part of delivering that,” observed a strategist at a Colorado infusion firm.

The Liposoll Era

This absorption impasse is no recent discovery. Early cannabis pharmacology in the 1970s illuminated the hurdles: THC’s poor solubility yields clumpy particulates that evade efficient uptake, while gastric acids further erode potency. Beverages exacerbate the issue; cannabinoids float inertly in tonics, demanding vigorous shaking and still yielding patchy results. The market’s response has been iterative.

Sublingual tinctures sidestep digestion for 15–35% bioavailability, but their bitter profile limits appeal. Transdermals and sprays offer consistency yet feel clinical.

Since the mid-2010s, emulsion technologies have proliferated, shrinking cannabinoid droplets to billionths of a meter. Nanoemulsions, propelled by ultrasonic waves or high-shear mixing, disperse oils into water-compatible spheres, boosting surface area for quicker dissolution. Brands like KANHA deploy VESIsorb, a nanotech variant, to shave onset to 10-15 minutes in gummies. Elsewhere, Azuca’s TiME Infusion encapsulates THC in thermodynamic shells, mimicking inhalation’s timeline while preserving edibility. These approaches elevate bioavailability to 30–50% in trials, though variability persists across formulations.

Liposomal vectors, by contrast, mimic cell membranes, wrapping cannabinoids in phospholipid bubbles that ferry them intact through the gut. Research from 2025 highlights their edge in stability: one study found liposomal CBD dissolving 94% in simulated intestinal fluid versus 28% for plain tablets. Yet liposomes demand refrigeration and falter in beverages, where surfactants destabilize the spheres. Liposoll Nanoemulsions are impactful here, their kinetic stability enduring shelf life without refrigeration. A head-to-head analysis underscores the trade-offs: nanoemulsions surge to peak plasma faster, ideal for beverages, while liposomes excel in sustained release for topicals.

Amid this toolkit, hybrid systems are emerging as frontrunners. In Tel Aviv, a team of material scientists has refined a process that compounds liposomal encapsulation with self-nanoemulsifying agents, yielding a powder form that bypasses digestion altogether.

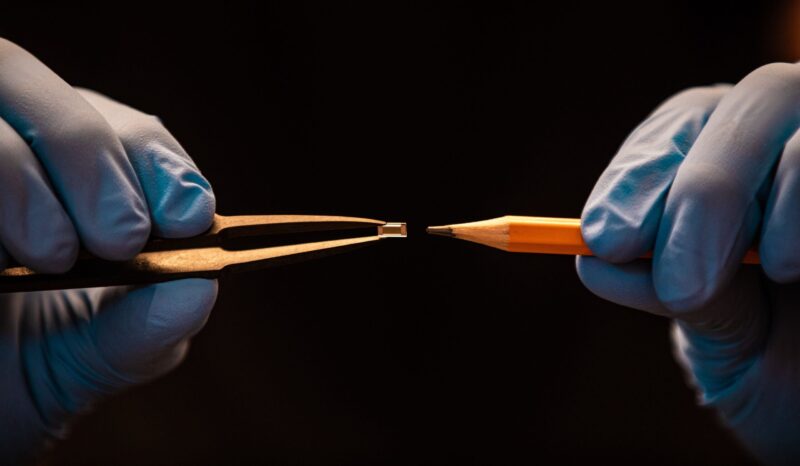

“Our core innovation is Liposoll technology,” explained Cytrynbaum. “It converts hard-to-absorb oils into a fine powder that can enter the bloodstream directly through the mucous membranes, rather than relying on digestion in the GI tract.”

This powder emulsifies in your body as your body is 70% water, ensuring uniform dispersion. Applied to edibles or drinks, it claims over 90% absorption, rendering a 10-milligram dose predictably potent.

“Most oils or edibles absorb only 18–22% of active ingredients, but our products can exceed 90% absorption,” he added. “That means a 10 mg edible is effectively 10 mg. The experience is predictable, reliable, and consistent.”

Early adopters—including more than a dozen major U.S. multi-state operators—report streamlined manufacturing; the powder integrates seamlessly into recipes, from chews to seltzers, without altering texture or taste.

Powdered Pathways

The elegance lies in versatility. Unlike rigid nanoemulsions, which suit liquids best, this powder adapts to solids, gels, and even transdermals. It accommodates minor cannabinoids like CBG for focus and CBN for sleep, preserving the entourage effect with fidelity. Capsoil’s operating labs in Israel and production facilities across California, New York, Massachusetts, Utah, Illinois, and Canada form a truly global infrastructure, pairing advanced scientific innovation with premium oils sourced from trusted cultivators.

“The quality of the starting oil matters,” he said. “When working with premium THC or CBD oils, we rely on the client’s cultivation expertise. The better the raw material, the better the final product.”

Shelf-life bolsters practicality—two years unrefrigerated, defying the perishability of many emulsions. Cost efficiencies follow; clients cite savings in active ingredient needs, offsetting premium pricing. In beverages, where clarity and mouthfeel matter, the tech dissolves invisibly, avoiding the haze that plagues oil-based infusions. A 2025 infusion trends report forecasts such hybrids driving 15% annual growth in cannabis drinks, as consumers favor low-dose, fast-acting options.

Challenges persist, including regulatory mosaics, state variances in the U.S., federal attitudes in Canada, and the complexities of scaling. Education lags too; manufacturers must grasp the shift from crude mixing to molecular engineering.

“People needed to understand what Liposoll is, how it works, and why combining liposomal and self-nano drug delivery systems matters,” Cytrynbaum reflected. Still, pilot programs yield “overwhelmingly positive” feedback, with more than 127 global partners validating rapid, consistent uptake.

Beyond the Lab

These strides ripple outward. In wellness aisles, fast-acting edibles court novices wary of overindulgence, aligning with microdosing’s ascent. Medical circles eye precision for epilepsy or chemotherapy adjuncts, where timing trumps tolerance. Globally, expansion beckons: Japan’s nascent market craves discreet formats, while Brazil’s hemp economy invites nutraceutical crossovers. By 2034, edibles could swell to $54 billion worldwide, per Global Market Insights, with tech-infused lines leading.

Skeptics caution against hype. Not all nano claims withstand scrutiny; particle aggregation can mute gains, and long-term safety data still trails innovation. Still, the trajectory points upward. What was once alchemy is evolving into science, granting users greater command over their experience.

In a field forever chasing the immediacy of inhalation, these powders offer a new compact: effects as intended, arrival assured.

Author

-

Paul McKay is a writer and editor with a background spanning from sports journalism and social media growth to stand-up comedy. He has multiple years of experience writing within the cannabis industry, as well as creating content for technology advisory companies and popular satirical websites. Growing up in the Atlanta area, Paul draws inspiration from Hunter S. Thompson, blending sharp humor with precision in his work.