In a clandestine Denver basement, amid whiteboards and legal tomes, Bob Hoban and Dotan Melech conceived CTrust in 2022. Hoban, a veteran attorney who has counseled more than 30 governments on cannabis policy, and Melech, a receivership specialist thrust into the sector via a court-appointed oversight of a Nevada cannabis operation in 2019, bonded over shared travails in distressed assets.

“We were in a basement in Denver in this historic building trying to hatch a plan to mitigate and address risk in the cannabis space,” Hoban recalled.

Their genesis stemmed from observing the industry’s maturation, from a frenzied equity influx to a debt-dependent reality, where traditional financial safeguards faltered.

Collateral Conundrums

Cannabis financing defied convention, ensnared by federal Schedule I status and a patchwork of state regulations. Lenders grappled with collateral that was perishable and legally precarious; seizing cannabis inventory demanded navigating licenses and statutes that rendered foreclosure a quagmire.

“If you try to foreclose on a cannabis company and your asset is cannabis product, what are you going to do with it? You depend on the company and the license holder. This is one of those unique situations where the borrower has the upper hand,” Melech explained.

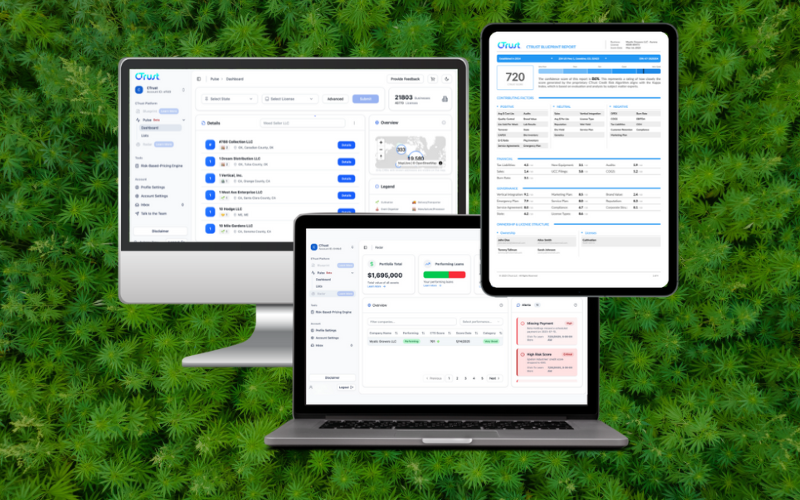

High-interest loans, often 3% monthly, reflected this opacity, pricing in unknowns rather than measured perils. CTrust countered with specialized tools including Blueprint for credit reports, Pulse for prospecting, and Radar for ongoing monitoring, leveraging data to quantify variables like regulatory shifts and license disparities.

Federal Roadblocks

Hoban underscored the federal overhang as the paramount barrier.

“The biggest thing is the elephant in the room: banks in the United States will not go completely in until cannabis is federally treated as something that’s permitted. And right now it’s not.”

Yet, economic imperatives propelled banks forward; deposits alone no longer sufficed, and lending yielded superior returns amid waning fees. Melech noted a $10 million loan equated to managing 240 deposit accounts in profitability, spurring institutions to explore despite risks.

Also Read: 2025 Last Minute Stocking Stuffer Guide

Policy on the Horizon

Speculating on policy, Hoban anticipated reform under the current administration, favoring descheduling to bifurcate adult-use markets from pharmaceutical cannabinoids.

“I do believe that you need to deschedule the plant ultimately,” he asserted, viewing Republicans’ transactional bent as advantageous.

Melech concurred, predicting shifts by midterms, urging operators to prepare for institutional influxes. Both emphasized transparency: creditworthy firms had to embrace scrutiny to access sustainable capital, transforming a people-centric industry—hampered by advertising bans and stigma—into one resilient against volatility.

As banks inched closer, driven by necessity, CTrust embodied the sector’s pivot toward standardized scrutiny, potentially unlocking billions in lower-cost funds. Yet, until federal clarity emerged, lenders and operators navigated a tenuous equilibrium, where innovation tempered inherent precarity.

Author

-

Aron Vaughan is a journalist, essayist, author, screenwriter, and editor based in Vero Beach, Florida. A cannabis activist and tech enthusiast, he takes great pride in bringing cutting edge content on these topics to the readers of Cannabis & Tech Today. See his features in Innovation & Tech Today, TechnologyAdvice, Armchair Rockstar, and biaskllr.