The legalization of cannabis in New England has created a significant impact on the region’s economy. Six states in New England, namely Vermont, Massachusetts, Rhode Island, Connecticut, New Hampshire, and Maine, have legalized cannabis for either medical or recreational use. With a population of more than 14 million people, the New England cannabis market presents a vast opportunity for growth and investment.

Massachusetts: Leading the Way

Massachusetts was the first state in New England to legalize cannabis for recreational use in 2016. In its first year of legal adult-use sales, Marijuana Business Daily reported the state pulled in more than $400 million. Its cannabis market is expected to grow exponentially in the coming years, with a projected revenue of $2.6 billion by 2025.

Vermont: A Pioneer in Legalization

Vermont was the first state in New England to legalize cannabis for medical use in 2004, later legalizing adult use in 2018. The state’s cannabis market is relatively small. However, the industry projected to generate more than $120 million by 2026, according to the 2022 MJBiz Factbook.

Rhode Island: A Growing Market

Rhode Island legalized cannabis for medical use in 2006 and recently approved the legalization of adult-use cannabis in 2022. The state’s cannabis market is in its early stages of growth, with Statista projecting revenue of $167 million by 2025. Rhode Island is home to several successful cannabis companies, including Curaleaf, one of the largest cannabis companies in the world.

Connecticut: A New Entrant

Connecticut legalized cannabis for medical use in 2012 and approved the legalization of adult-use cannabis in 2021. The legalization of adult-use cannabis is expected to provide a boost to the state’s economy, with Statista projecting revenue of $160 million by 2025.

New Hampshire and Maine: Emerging Markets

New Hampshire and Maine legalized cannabis for medical use in 2013 and 1999, respectively. Both states recently approved the legalization of adult-use cannabis, and their cannabis markets are in the early stages of growth. These states are expected to make sizable contributions to the New England cannabis market. In this issue’s Regional Spotlight, Cannabis & Tech Today will explore some of the innovators and entrepreneurs making an impact in the Northeast.

Tested and True: Bringing Precision Analytical Tools to New England’s Producers

The cannabis industry in New England is expanding rapidly. With more states legalizing in the Northeast, there is increased demand for analytical testing. Testing is crucial to ensure consumers receive safe, high-quality products.

This includes testing for the potency of THC and CBD, as well as for contaminants such as heavy metals, pesticides, and mold. Growers, processors, and dispensaries use the results of these tests to make informed decisions about the products they produce and sell. Testing also protects consumers and informs regulators.

However, in the New England region, there are several challenges to creating a comprehensive analytical testing program. One of the main challenges is a lack of standardization. Unlike other industries, the cannabis industry does not have a standardized method for testing, which can lead to inconsistent results and confusion for consumers.

Additionally, there is currently no federal regulatory framework for cannabis testing, so states are left to create their own regulations. This can lead to a patchwork of regulations across the region, making it difficult for businesses to comply with all the requirements.

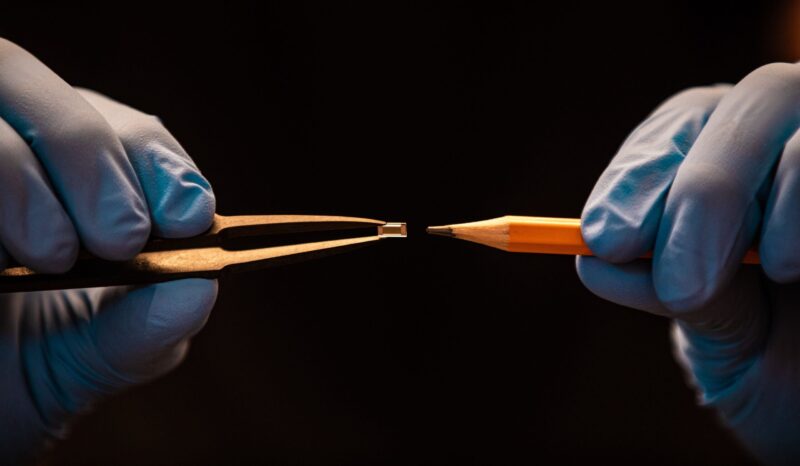

Purpose-built technologies are making it easier to conduct precision cannabis testing. Orange Photonics’ LightLab 3 Cannabis Analyzer can measure small concentrations of cannabinoids, down to 1.7 ppm. This is especially crucial for edibles and beverages. Orange Photonics Chief Technical Officer Dylan Wilks told Cannabis & Tech Today that pinpoint accuracy is becoming vital for the industry. “1.7 ppm doesn’t sound that impressive until you realize that’s less than a grain of salt in a 12-ounce beverage — not an easy thing to quantify!”

As a wider variety of products hit New England shelves, customers expect accurate test results to gauge potency, purity, and dosage. Wilks said he’s eager to see the industry adopt more stringent protocols for quality testing. “Moving toward manufacturing processes that align with current food and drug production standards will elevate product quality and ultimately allow for safer products for consumers.”

Some New England states, such as Massachusetts, have established strict regulations and standards for cannabis testing, including requirements for accreditation and training for laboratory personnel. Additionally, organizations like the American Council of Independent Laboratories are working to promote best practices and establish standardized methods for testing.

Retailers and producers have more to gain than pleasing regulators and maintaining customer satisfaction. Cutting-edge lab equipment can help a brand stand out from its competitors.

Wilks noted, “While ‘test’ is a four-letter word for many organizations who want to

avoid the cost and complexity of testing, it’s also an area where a producer can truly differentiate. Whether it’s phenohunting for the next big cultivar or catching a quality issue before it becomes a nightmare, having in-house capability is more essential than ever for producers.”

Gummy Sales Are Up Across New England

If you could participate in an industry worth $108 billion, would you? Data Bridge Market Research expects the global cannabis edibles market will be worth at least that much by 2029. As manufacturers in New England consider how to make the most of the region’s growing cannabis scene, gummies and cannabis edibles should be among their top priorities.

Edibles made up 12.1% of American cannabis sales in Sept. 2022, according to data analysis company Headset. Gummies were responsible for nearly 74% of those sales. Massachusetts reportedly has the second-highest demand for edibles in the country.

With these numbers in mind, it makes sense more manufacturers and producers are leaning into the edibles market. For many, the only question is how to start and with whom to partner for reliable production.

Making a delicious gummy isn’t as easy as it sounds, just ask anyone who has tried a bad one. But some companies figured out how to do it right. Heritage CBD, a hemp company based in Northampton, Massachusetts, found success with its CBD gummies. Manufacturers in the area caught on and started approaching the founders for the secret behind their best-selling creations.

Heritage Hemp Co-Founders Sarah McLaughlin and Tim Van Epps saw an opportunity to help producers nationwide create consistent, shelf-stable gummies using their patent-pending processes.

The duo created Melt-to-Make Gummy Base, allowing manufacturers to add their own botanical blends to an all-natural, tasty base. Melt-to-Make now offers manufacturers a variety of flavors and two options for a base, pectin or gelatin.

The add-your-own distillate approach is especially helpful in New England states like Massachusetts, which prohibits edibles from containing more than 5 milligrams of THC per serving. The distillate must be independently tested, precisely measured, then added to a base before shipping out to retail shelves. Retailers in New England are finding edibles especially popular — perhaps because edibles are one of the few ways to consume publicly.

While most states in New England have legalized, there are very few places to smoke cannabis outside of a private residence. Canna-tourists and those seeking to partake while out and about are more likely to discreetly eat an edible than smoke a pre-roll.

Producers seeking an affordable entryway into the gummy space should find a partner who can support their journey. Melt-to-Make Sales Director Kirsten Wedegartner told Cannabis & Tech Today, “We provide SOP templates, work instructions, equipment lists, and video tutorials along with our gummy bases. This way, producers can focus on their core competency rather than dealing with supply chain issues, expiration dates, and the inventory and carrying costs associated with typical gummy manufacturing.”

Considering “CBD gummies” was the third most-searched food item on Google last year, it’s likely edibles will only continue to grow in popularity as the cannabis scene expands across the East Coast.

Overcoming New England’s Challenging Post-Harvest Environment

Drying and curing cannabis are two essential stages in the process of producing high-quality flower. In New England, the harsh and unpredictable weather conditions of the region can make the process a challenge. However, with the right techniques, it is possible to produce buds that are flavorful, aromatic, and potent.

Drying is the process of removing moisture from freshly harvested cannabis buds, which allows for preservation and helps to enhance the aroma and flavor of the buds.

The ideal temperature for drying cannabis is between 60 and 70 degrees Fahrenheit, with a relative humidity of 50-60%. In New England, however, the high humidity levels during the summer months can make it difficult to achieve these conditions. To overcome this, growers in the region often use dehumidifiers and air-conditioners to maintain the ideal environment for drying.

VT Dry & Cure Technologies’ Cannatrol System is taking a fresh approach to the process. The company’s twice-patented Vaportrol tech is helping New England growers reduce labor costs and preserve terpenes.

VT’s President and Co-founder Jane Sandelman told Cannabis & Tech Today, “New England is certainly unique! Bone dry in the winter and humid in the summer. When you have wild climate swings, it’s hard to control the post-harvest environment.”

She explained traditional HVAC systems are not designed to dry and cure cannabis. Cannatrol allows users to control vapor pressure to create an ideal environment.

“Generally, our customers ask us about the technology and why we use temperature and dew point versus relative humidity. The answer is simple — it’s physics! You can’t control RH because it’s made up of two components: dew point and dry bulb temperature. Our technology gives you independent control of those components. When you have that level of control, you can create a very stable, consistent environment.”

It is important to note that the drying and curing process can be an opportunity for growers to further tailor the flavor and potency of their buds. By using different techniques and adjusting the environment, growers can create unique, high-quality cannabis products that stand out from the rest.

Sandelman noted, “It’s all about the science. The more we can apply real science to our work, the more we can create consistent, repeatable processes. When the post-harvest process is in control, it gives cultivators of all sizes the ability to focus on other areas of the grow.”

While drying and curing cannabis in New England can be a challenging process, with the right techniques and equipment, it is possible to produce buds that are flavorful, aromatic, and potent. By paying close attention to the timing of the harvest and the environment, growers in the region can overcome the challenges and produce top-quality cannabis products that are sought after by consumers.